Launching an e-business is easier than ever, but scaling it sustainably is where most entrepreneurs struggle. The difference between a short-lived startup and a long-term success often comes down to one factor: smart financing.

From early bootstrapping to growth-stage funding, every phase of an electronic commerce business requires different financial decisions. Understanding how to finance an e-business strategically helps founders avoid cash shortages, reduce risk, and scale with confidence.

Understanding the Financial Stages of an E-Business

Every online business moves through clear financial stages. Each stage demands a different approach to funding and money management.

Common stages include:

-

Startup and validation

-

Early growth

-

Expansion and scaling

-

Stabilization and optimization

Recognizing your current stage allows you to choose financing options that support growth without overextending resources.

Bootstrapping: The Smart Start for Many E-Businesses

Most successful e-businesses begin with bootstrapping. This means using personal savings or early revenue to fund operations.

Why bootstrapping works:

-

Full ownership and control

-

Strong focus on profitability

-

Lower financial risk

-

Better spending discipline

Bootstrapping encourages founders to validate demand before seeking external funding.

Managing Cash Flow in the Early Stages

Cash flow is the lifeline of any online business finance strategy. Even profitable startups can fail if cash flow is poorly managed.

Early-stage priorities include:

-

Keeping fixed costs low

-

Tracking all expenses carefully

-

Reinvesting revenue strategically

-

Avoiding unnecessary tools and subscriptions

Strong cash flow habits formed early support smoother scaling later.

When to Seek External Funding

As an e-business grows, internal cash may not be enough to support expansion. Smart founders seek funding only when there is a clear return on investment.

Common signals include:

-

Consistent sales growth

-

Proven customer demand

-

Clear expansion opportunities

-

Predictable revenue patterns

Funding should accelerate growth, not compensate for weak fundamentals.

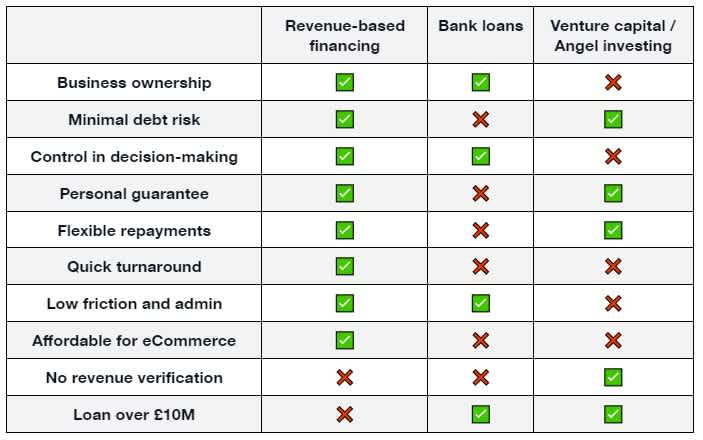

Smart Financing Options for Growing E-Businesses

Modern e-business financing offers more flexibility than traditional loans.

Popular options include:

-

Revenue-based financing

-

Working capital advances

-

Short-term business loans

-

Platform-based merchant funding

These options align funding with real performance, reducing long-term financial pressure.

Using Financial Data to Guide Scaling Decisions

Data-driven finance separates scalable businesses from risky ones. Every transaction provides insight into business health.

Smart scaling relies on:

-

Tracking profit margins

-

Monitoring customer acquisition cost

-

Measuring lifetime customer value

-

Forecasting revenue and expenses

Financial data ensures expansion decisions are based on reality, not assumptions.

Balancing Growth and Financial Stability

Rapid growth can strain finances if not planned carefully. Scaling responsibly means growing at a pace your finances can support.

Key principles include:

-

Maintaining sufficient cash reserves

-

Avoiding over-dependence on debt

-

Scaling marketing spend gradually

-

Investing in automation at the right time

Stability allows growth to compound rather than collapse.

Controlling Costs While Scaling

As operations grow, costs increase quickly. Smart e-businesses monitor spending closely during expansion.

Focus areas include:

-

Advertising efficiency

-

Logistics and fulfillment costs

-

Technology and software expenses

-

Staffing and outsourcing decisions

Cost control protects margins and preserves flexibility.

Risk Management and Financial Protection

Scaling introduces new financial risks. Fraud, chargebacks, and compliance issues become more complex as volume increases.

A smart finance strategy includes:

-

Secure payment systems

-

Fraud detection tools

-

Regular financial reviews

-

Clear financial policies

Risk management protects both revenue and reputation.

Common Financing Mistakes to Avoid

Many e-businesses struggle due to avoidable financial errors.

Avoid these mistakes:

-

Raising money too early

-

Scaling before product-market fit

-

Ignoring cash flow warnings

-

Overspending on growth without tracking ROI

Smart financing focuses on sustainability, not speed alone.

Conclusion

Financing an e-business the smart way means aligning funding decisions with growth stages, data, and long-term goals. From bootstrapping to expansion funding, each choice should strengthen financial stability rather than weaken it.

Businesses that treat finance as a strategic function—not just accounting—are far more likely to scale successfully. Smart financing turns ambition into lasting growth.